Financial Indicators

- Performance Highlights

- Asset Status

- Per Share indicators (Yen)

- Cash Flow

- Capital Expenditures and R&D

Performance Highlights

| Fiscal year ended | IFRS | ||||

|---|---|---|---|---|---|

| Dec. 2020 | Dec. 2021 | Dec. 2022 | Dec. 2023 | Dec. 2024 | |

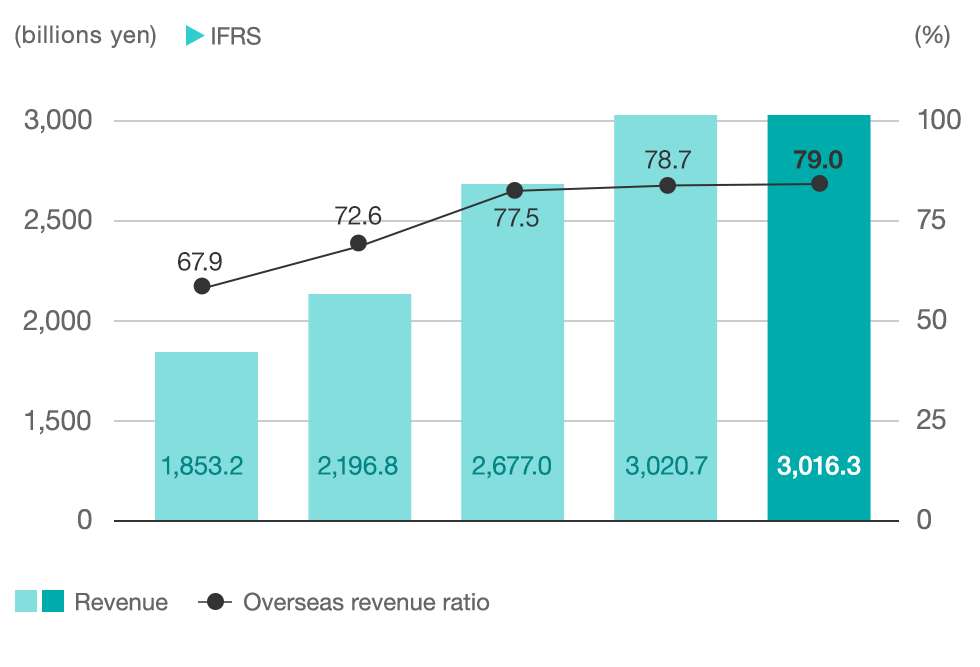

| Revenue | 1,853.2 | 2,196.8 | 2,677.0 | 3,020.7 | 3,016.3 |

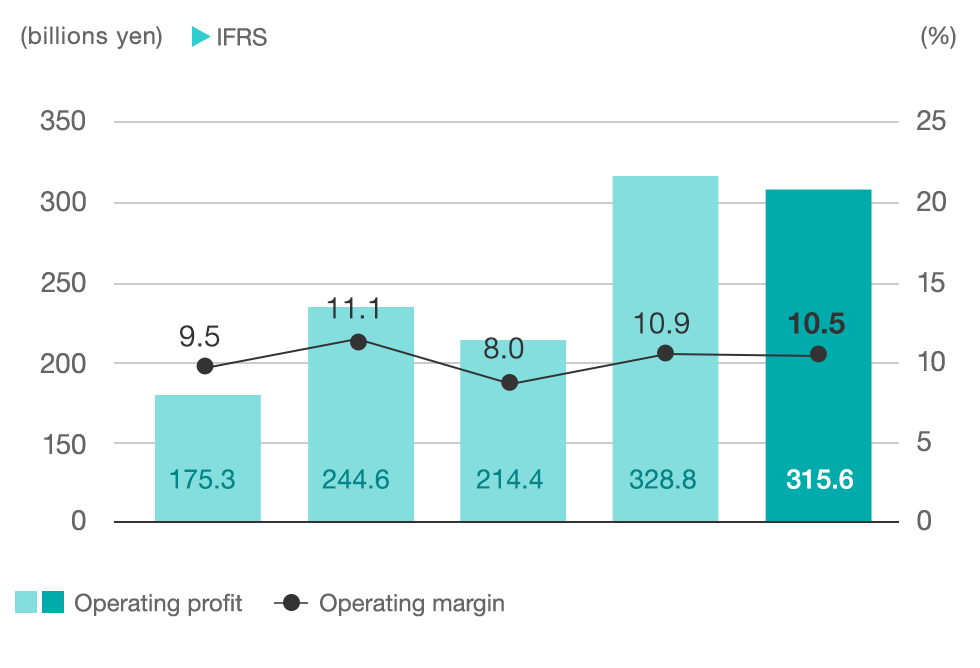

| Operating Profit | 175.3 | 244.6 | 214.4 | 328.8 | 315.6 |

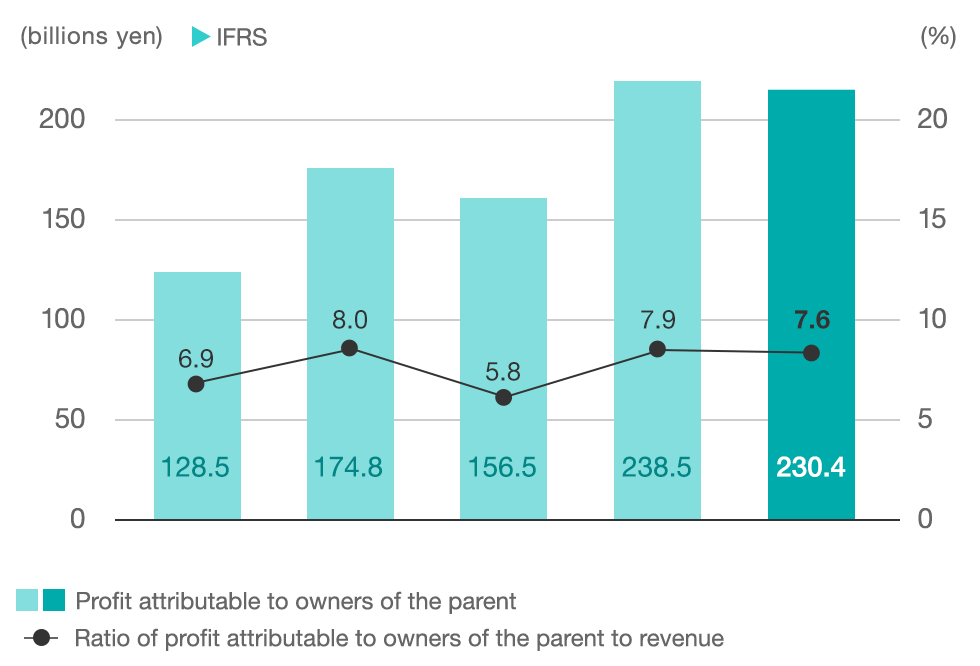

| Profit attributable to owners of the parent | 128.5 | 174.8 | 156.5 | 238.5 | 230.4 |

| IFRS | ||||

|---|---|---|---|---|

| Dec. 2020 | Dec. 2021 | Dec. 2022 | Dec. 2023 | Dec. 2024 |

| Revenue | ||||

| 1,853.2 | 2,196.8 | 2,677.0 | 3,020.7 | 3,016.3 |

| Operating Profit | ||||

| 175.3 | 244.6 | 214.4 | 328.8 | 315.6 |

| Profit attributable to owners of the parent | ||||

| 128.5 | 174.8 | 156.5 | 238.5 | 230.4 |

-

Revenue and Overseas Revenue Ratio

- 2020.12

- 2021.12

- 2022.12

- 2023.12

- 2024.12

-

Operating profit and Operating margin

- 2020.12

- 2021.12

- 2022.12

- 2023.12

- 2024.12

-

Profit attributable to owners of the parent and Ratio of profit attributable to owners of the parent to revenue

- 2020.12

- 2021.12

- 2022.12

- 2023.12

- 2024.12

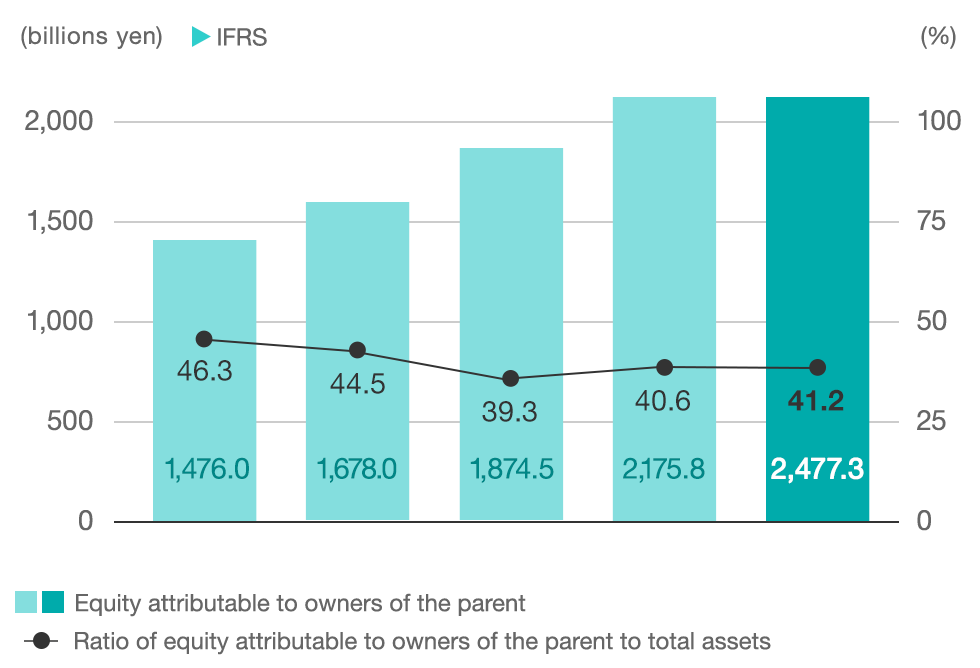

Asset Status

| Fiscal year ended | IFRS | ||||

|---|---|---|---|---|---|

| Dec. 2020 | Dec. 2021 | Dec. 2022 | Dec. 2023 | Dec. 2024 | |

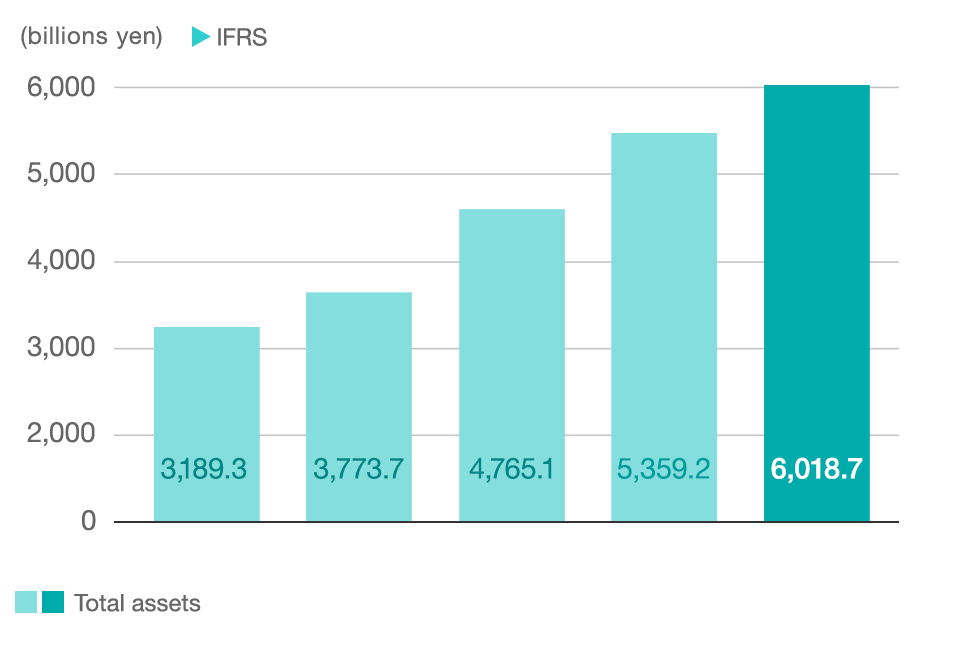

| Total Assets | 3,189.3 | 3,773.7 | 4,765.1 | 5,359.2 | 6,018.7 |

| Equity attributable to owners of the parent | 1,476.0 | 1,678.0 | 1,874.5 | 2,175.8 | 2,477.3 |

| IFRS | ||||

|---|---|---|---|---|

| Dec. 2020 | Dec. 2021 | Dec. 2022 | Dec. 2023 | Dec. 2024 |

| Total Assets | ||||

| 3,189.3 | 3,773.7 | 4,765.1 | 5,359.2 | 6,018.7 |

| Equity attributable to owners of the parent | ||||

| 1,476.0 | 1,678.0 | 1,874.5 | 2,175.8 | 2,477.3 |

-

Total Assets

- 2020.12

- 2021.12

- 2022.12

- 2023.12

- 2024.12

-

Equity attributable to owners of the parent and Ratio of equity attributable to owners of the parent to total assets

- 2020.12

- 2021.12

- 2022.12

- 2023.12

- 2024.12

-

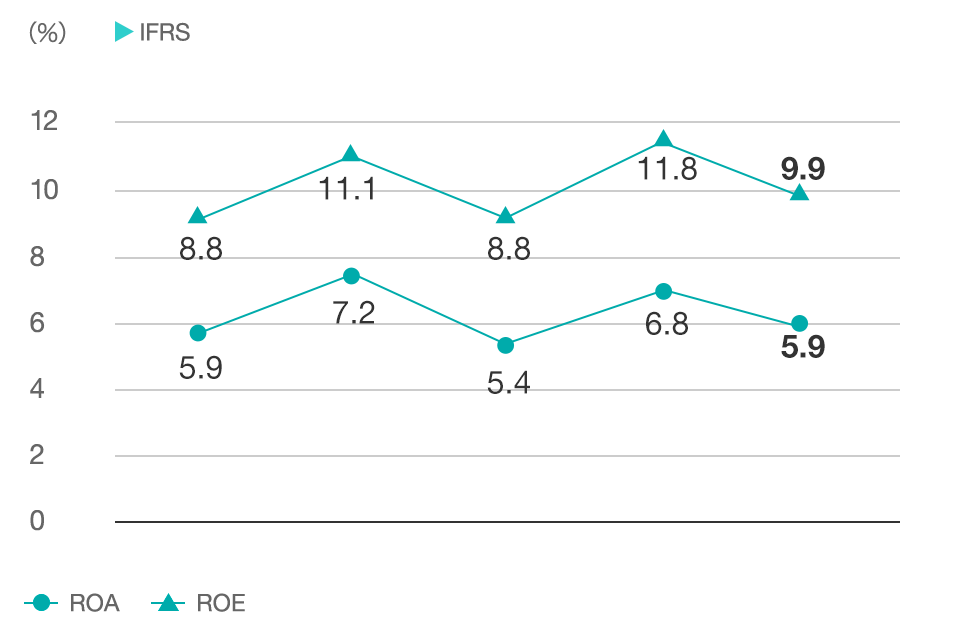

ROA*1/ROE*2

- 2020.12

- 2021.12

- 2022.12

- 2023.12

- 2024.12

- *1ROA = Profit before income taxes ÷ Total assets (average of beginning and end of fiscal year)

- *2ROE = Profit attributable to owners of the parent ÷ Equity attributable to owners of the parent (average of beginning and end of fiscal year)

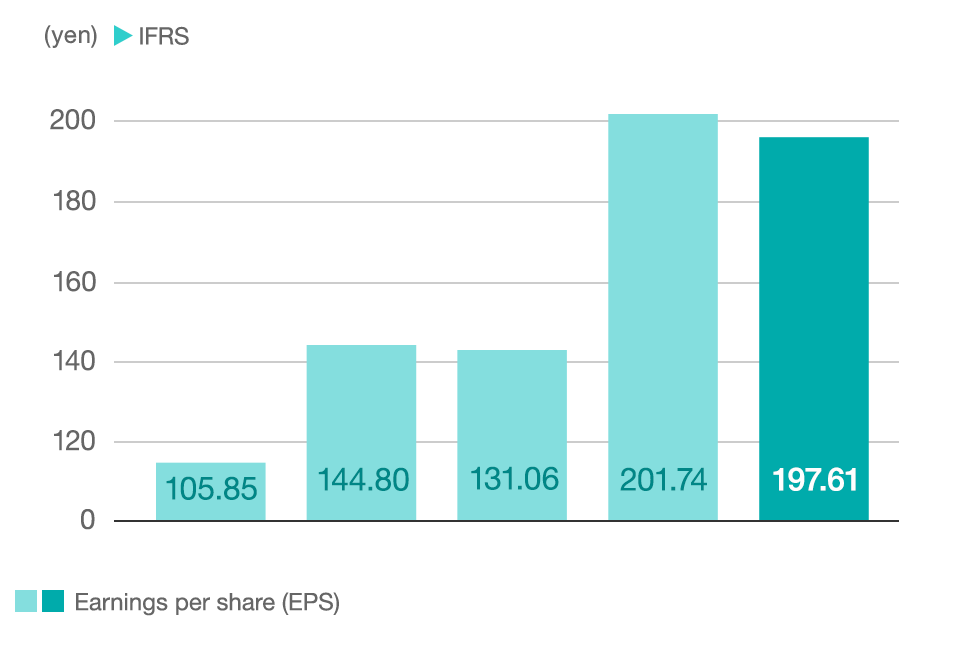

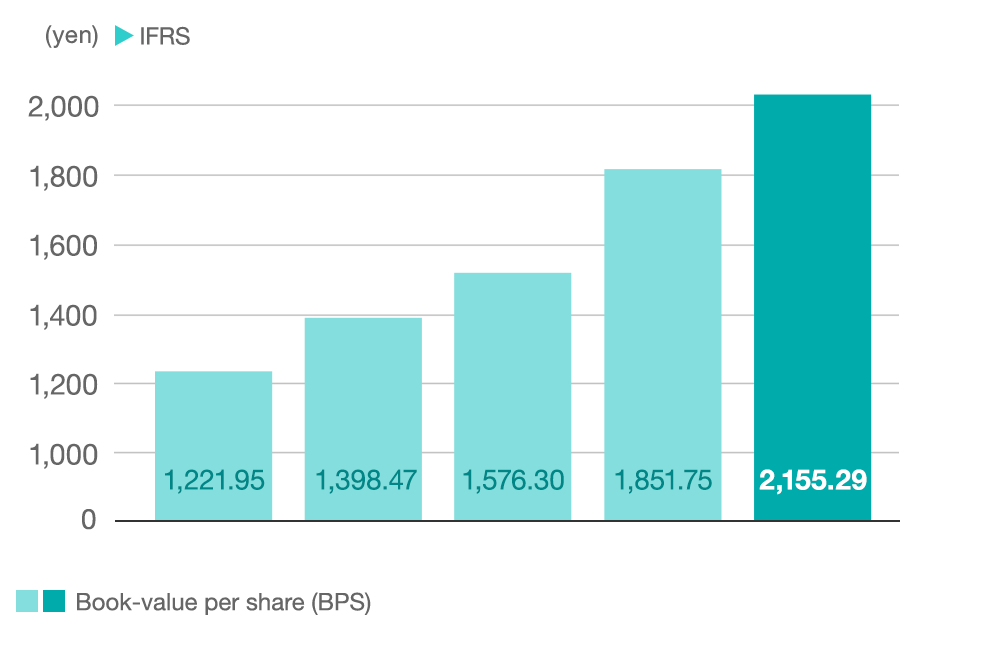

Per Share Data (Yen)

| Fiscal year ended | IFRS | ||||

|---|---|---|---|---|---|

| Dec. 2020 | Dec. 2021 | Dec. 2022 | Dec. 2023 | Dec. 2024 | |

| Earnings per share(EPS) | 105.85 | 144.80 | 131.06 | 201.74 | 197.61 |

| Book-value per share(BPS) | 1,221.95 | 1,398.47 | 1,576.30 | 1,851.75 | 2,155.29 |

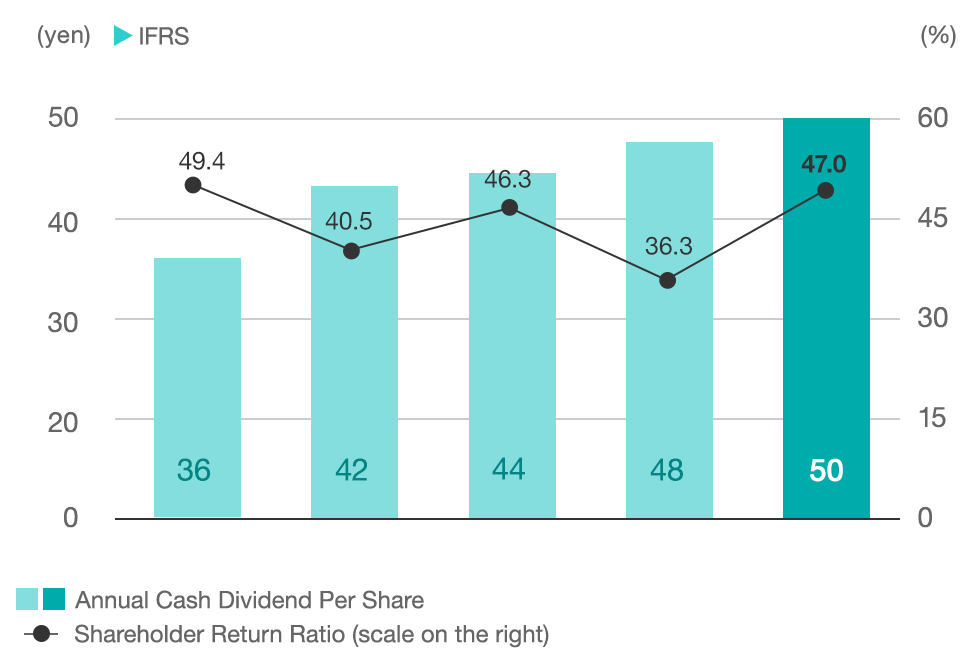

| Annual Cash Dividend | 36 | 42 | 44 | 48 | 50 |

| IFRS | |||||

|---|---|---|---|---|---|

| Dec. 2020 | Dec. 2021 | Dec. 2022 | Dec. 2023 | Dec. 2024 | |

| Earnings per share(EPS) | |||||

| 105.85 | 144.80 | 131.06 | 201.74 | 197.61 | |

| Book-value per share(BPS) | |||||

| 1,221.95 | 1,398.47 | 1,576.30 | 1,851.75 | 2,155.29 | |

| Annual Cash Dividend | |||||

| 36 | 42 | 44 | 48 | 50 | |

-

Earnings per share(EPS)

- 2020.12

- 2021.12

- 2022.12

- 2023.12

- 2024.12

-

Book-value per share(BPS)

- 2020.12

- 2021.12

- 2022.12

- 2023.12

- 2024.12

-

Annual Cash Dividend Per Share and Shareholder Return Ratio

- 2020.12

- 2021.12

- 2022.12

- 2023.12

- 2024.12

Cash Flow

-

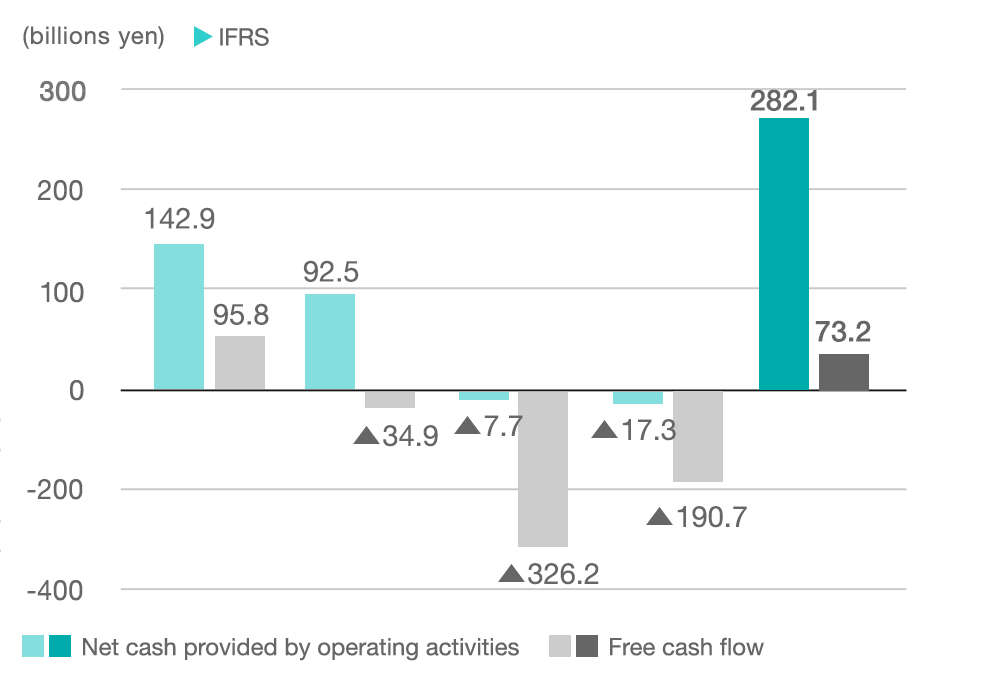

Net cash provided by operating activities and Free cash flow*3

- 2020.12

- 2021.12

- 2022.12

- 2023.12

- 2024.12

- *3Free cash flow = Net cash provided by operating activities – Net cash used in investing activities

Capital Expenditures and R&D

-

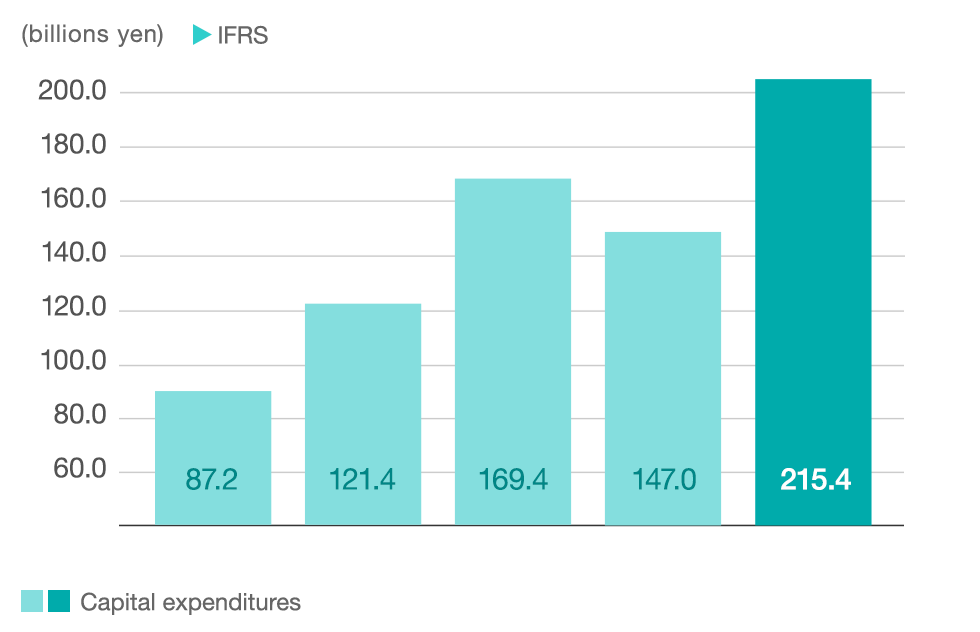

Capital expenditures

- 2020.12

- 2021.12

- 2022.12

- 2023.12

- 2024.12

-

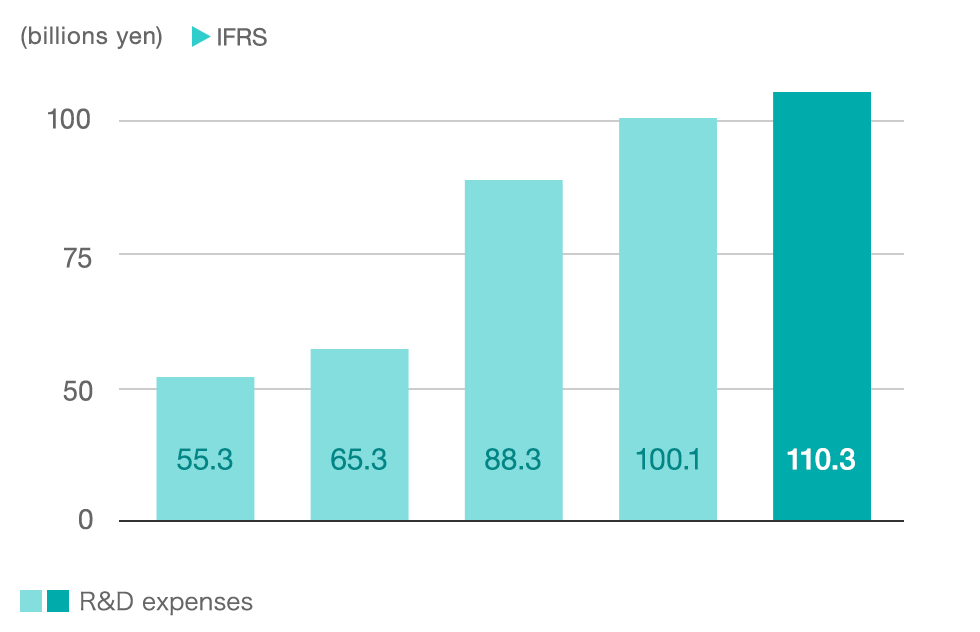

R&D expenses

- 2020.12

- 2021.12

- 2022.12

- 2023.12

- 2024.12