Corporate Governance

- Basic Policy of Corporate Governance

- Corporate Governance System

- Composition of the Board of Directors and the Audit & Supervisory Board

- Evaluation of the Board of Directors' Effectiveness

- Remuneration

Basic Policy of Corporate Governance

The Company has designated “long-term and stable growth of corporate value” as its highest management priority. To realize this aim, the Company considers enhancement of the satisfaction of all the Company’s stakeholders and improvement of overall corporate value, while balancing economic value and social value, to be important. Especially, in order to achieve the long-term objectives of building “Global Major Brand Kubota” on the basis of its corporate philosophy “Kubota Global Identity,” the Company must be an enterprise that is trusted not just in Japan but also worldwide. In order to enhance the soundness, efficiency, and transparency of business management, which are essential to earn trust, the Company is striving to strengthen its corporate governance.

Also, the Company has established the "Corporate Governance Policy," which is based on the Kubota's views and policies on corporate governance. The Company will endeavor to continuously review and improve its corporate governance by the Board of Directors and utilize this policy in dialogues with stakeholders.

Please refer to the "Corporate Governance Report" for the status of the implementation of the Corporate Governance Code.

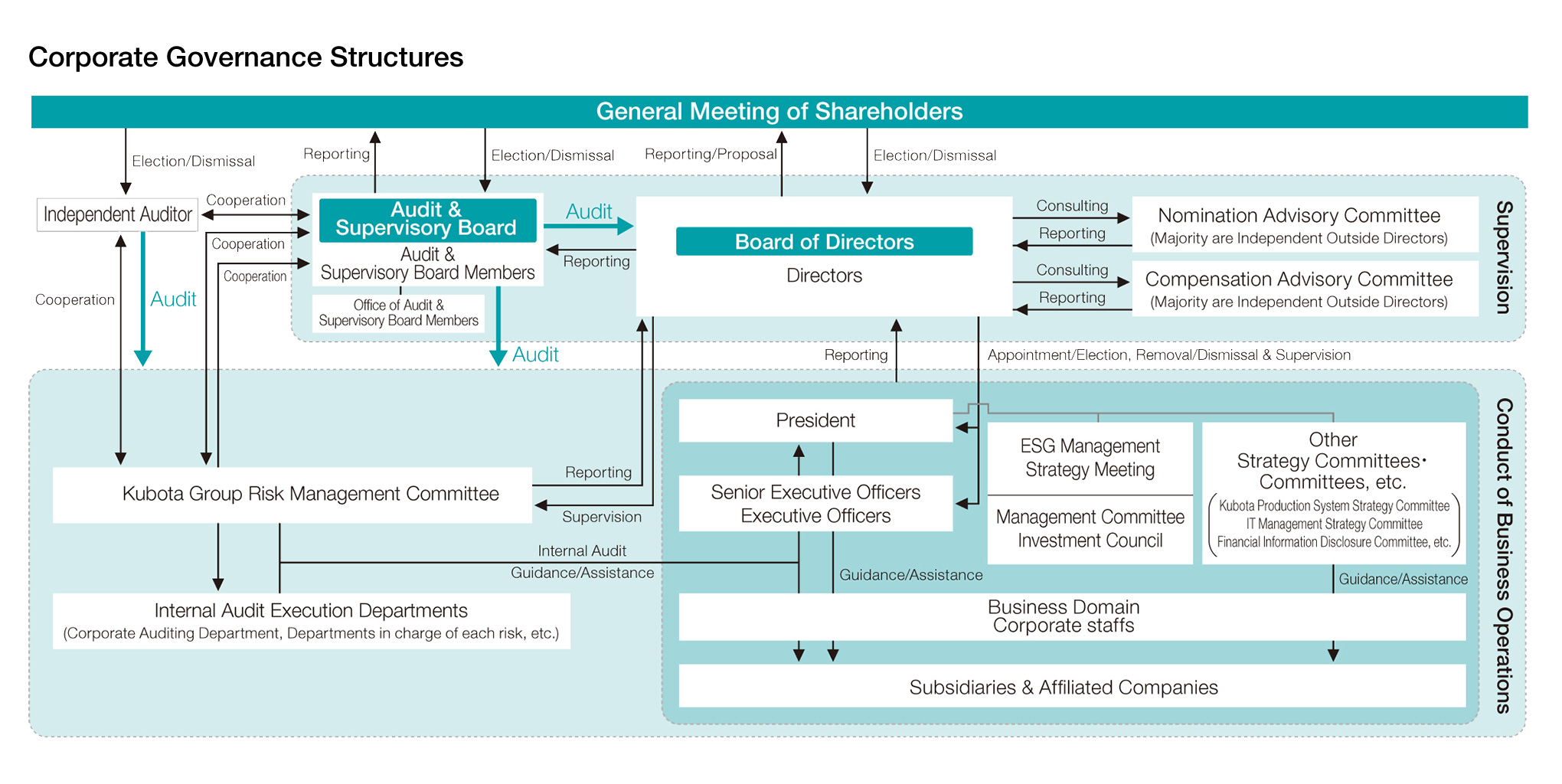

Corporate Governance System

Policy of Organization Structure

The Company is basically a company with an Audit & Supervisory Board but also has a voluntary Nomination Advisory Committee and Compensation Advisory Committee. The Company has a wide range of business domains that include the areas of food, water, and the environment. Considering the scope of these domains, the Company believes that the most appropriate governance structure is one in which the Board of Directors makes decisions on major fundamental management policies, based on the perspectives of internal Directors within-depth experience and knowledge in particular areas of the Company’s businesses as well as the objective viewpoints and broad knowledge of Outside Directors. The Board of Directors also supervises and oversees the Executive Officers’conduct of business. On the other hand, the Audit & Supervisory Board Members, who are legally independent from the Board of Directors, provide a monitoring function through the highly effective, independent audit function. The Company believes having the voluntary Nomination Advisory Committee and Compensation Advisory Committee, where the majority of members are Outside Directors, enables it to secure objectivity and transparency on matters regarding personnel and remuneration of officers, etc., and attain sustainable growth and increase its corporate value in the medium to long term while securing sound, efficient, and effective business management.

Corporate Governance Structure

Board of Directors

The Board of Directors makes strategic decisions and oversees the execution of duties by the Directors and Executive Officers. In addition to its regular monthly board meetings, it also meets as and when required to discuss and make decisions relating to management planning, financial planning, investment, business restructuring, and other important management issues.

Value Up Discussion Meeting

The Company regularly holds Value Up Discussion Meetings to provide members of the Board with opportunities to discuss topics bringing about sustainable growth and increasing corporate value. The purpose of the meeting is to exchange opinions and share information, and the contents of discussions are communicated to the executive as necessary.

Audit & Supervisory Board

Kubota has the Audit & Supervisory Board independently, which oversees and audits the execution of duties by the Directors.

In addition to its regular monthly Audit & Supervisory Board Meetings, it also meets as and when required to discuss and make decisions on auditing policy, audit reports, and other matters.

Nomination Advisory Committee and Compensation Advisory Committee

The Company has a voluntary Nomination Advisory Committee and Compensation Advisory Committee in place as the advisory body of the Board of Directors.To incorporate the independent and objective standpoint, Outside Directors account for more than half of constituent members of both committees, and an Independent Outside Director serves as chairperson of the committees.

The Nomination Advisory Committee is held for the purpose of deliberating the nomination of candidates for Director and the nomination of Advisors. The committee is also looking at the composition and diversity of the Board of Directors using the skills matrix. Starting in fiscal 2022, the committee added matters related to electing as well as dismissing a president along with succession planning to its agenda once again and actively discusses the qualities and abilities required of the Company’s top management in addition to training methods.

The Compensation Advisory Committee is held for the purpose of discussing both the consistency of levels of compensation paid to the Directors, Executive Officers, Special Corporate Advisor and Advisors, and the adequacy of the compensation system. Under the current compensation system, the committee set competitive remuneration levels appropriate for a GMB, and introduced an evaluation system that is strongly linked to growth over the short, medium and long term in order to realize the Company’s Long-Term Vision as set forth in “GMB2030.”

Please refer to the Kubota Group Integrated Report and ESG Report for further information on the activities by the Board of Directors, Audit & Supervisory Board, Nomination Advisory Committee and Compensation Advisory Committee.

ESG Management Strategy Meeting and Management Committee

The Company has established the ESG Management Strategy Meeting and the Management Committee to make decisions and deliberate on specific important issues. The ESG Management Strategy Meeting formulates policies and evaluates major measures for the realization of the Long‐Term Vision of the Company, GMB2030, and the creation of medium- to long‐term corporate value. The Management Committee deliberates and make decisions on important management issues, such as investments and loans, in accordance with the Mid‐Term Business Plan 2025. Of the management issues deliberated by the Management Committee, important issues are reported to the Board of Directors.

Composition of the Board of Directors and the Audit & Supervisory Board

Officers

Skills Matrix and status of the Board of Directors, etc.

Please refer to the Kubota Group Integrated Report and ESG Report for the information on the skills matrix of directors and Audit & Supervisory Board members and attendance at meetings of the Board of Directors, Audit & Supervisory Board and advisory committees.

Selection Policy for Director Candidates

In line with director regulations (selection criteria for candidates for the position of director), the Company appoints candidates as either directors or outside directors. The former, from within the Kubota Group, must have wide-ranging knowledge and a wealth of experience related to Kubota's business execution. For the latter, candidates must fulfill criteria for independent officers as set by the Tokyo Stock Exchange and independence criteria set by Kubota, and must possess practical, objective viewpoints and a high degree of knowledge. The aim of this selection policy is to ensure that Kubota―as a company involved in a wide range of business areas in the fields of food, water, and the environment―carries out appropriate decision-making and supervision of operations, and that the entire Kubota Group can grow sustainably and improve its corporate value.

Selection policy for Audit & Supervisory Board members

Candidates for appointment as Audit & Supervisory Board members must have the varied experience, knowledge, specialisms, and views needed for appropriate auditing and supervision. In terms of its membership, one member must have sufficient knowledge of finance and accounting, and more than half must fulfill criteria for independent officers as set by the Tokyo Stock Exchange and independence criteria set by Kubota.

Independent Criteria for Outside Directors/Audit & Supervisory Board Members

The Company has established the Independence Criteria for Outside Directors/Audit & Supervisory Board Members, considering laws and regulations, and provisions of the Tokyo Stock Exchange, among other regulations, to ensure transparency and objectivity in the governance of the Company. For the detailed information on the criteria, please refer to the following link.

Reasons for Appointment of Outside Officers

| Name | Reasons for Appointment |

|---|---|

| Yutaro Shintaku | Yutaro Shintaku has a high degree of skill and an impressive track record as a manager who is able to read trends. During his time as President and Representative Director of Terumo Corporation, he took a number of measures to ensure the company could overcome intense international competition, including global expansion, M&As, and restructuring of the company’s business portfolio. Moreover, he actively offers advice, particularly based on his knowledge of capital policies at meetings of the Board of Directors of Kubota Corporation, while also playing a proper role with respect to management oversight. He was nominated as a candidate for Outside Director based on the judgment that he has the ability to continue to contribute to the sustainable growth and improvement of corporate value of the Company. |

| Kumi Arakane | At KOSÉ Corporation, after being appointed as a researcher to work on fundamental cosmetics research, Kumi Arakane’s career has covered assignments in charge of a wide range of fields, including product development, R&D, quality assurance, and purchasing. She has experience in being involved in management as a director. She also possesses knowledge relating to auditing the execution of duties as a full-time auditor. Moreover, she actively offers advice from various perspectives at meetings of the Board of Directors of Kubota Corporation, while also playing a proper role with respect to management oversight. She was nominated as a candidate for Outside Director based on the judgment that she has the ability to continue to contribute to the sustainable growth and improvement of corporate value of the Company. |

| Koichi Kawana | Koichi Kawana’s career has involved responsibility for a business site outside Japan for JGC HOLDINGS CORPORATION, and he is well-versed in international business. In 2011, he was appointed as Representative Director and President there, and led megaprojects inside and outside Japan and business investment in infrastructure fields. He possesses extensive expertise and experience in management. He was nominated as a candidate for Outside Director based on the judgment that he has the ability to contribute to the sustainable growth and increased corporate value of the Company as well as strengthening supervisory functions of Kubota Corporation’s Board of Directors drawing on his deep insight. |

| Yuri Furusawa | Ms. Furusawa has experience in Japan and overseas in various roles working for central governmental agencies and possesses a broad perspective and extensive knowledge. Furthermore, she gained global experience through being involved in overseas business development at a company, and she was involved in reforming work styles and promoting the empowerment of women and diversity at the center of the government. She was nominated as a candidate for Outside Director based on the judgment that he has the ability to contribute to the sustainable growth and increased corporate value of the Company as well as strengthening supervisory functions of Kubota Corporation’s Board of Directors drawing on his deep insight. |

| Yoshinori Yamashita | As Representative Director, President and CEO of Ricoh Company, Ltd., Yoshinori Yamashita has extensive experience and broad-ranging knowledge as a manager.He has promoted structural reforms and growth strategies on a global scale. Additionally, he has contributed to enhancing corporate governance and business management systems, transforming the business structure from an OA (Office Automation) manufacturer into a digital services company, and improving profitability. He was nominated as a candidate for Outside Director based on the judgment that he has the ability to contribute to the sustainable growth and increased corporate value of the Company as well as strengthening supervisory functions of Kubota Corporation’s Board of Directors drawing on his deep insight. |

| Name | Reasons for Appointment |

|---|---|

| Yuichi Yamada | As a certified public accountant, Yuichi Yamada possesses considerable knowledge in finance and accounting. He has an extensive experience and a record of accomplishments in corporate auditing while serving at a major audit firm, and possesses extensive expertise on auditing in general through activities such as working as an outside audit & supervisory board member for other companies. Although he has never directly engaged in corporate management, he is nominated as a candidate for Outside Audit & Supervisory Board Member based on the judgment that he will contribute to the further enhancement of auditing processes of the Company through his expert point of view and from an independent standpoint. |

| Keijiro Kimura | Mr. Kimura possesses a wealth of knowledge in legal affairs. He also has an extensive record of practice in corporate legal affairs at attorney offices and considerable experience and knowledge acquired by assuming office as an outside auditor for several companies. Therefore, despite not having been directly involved in corporate management, the Company judged that he can contribute to further enhancing its auditing processes through his expert viewpoints and from an independent standpoint. |

| Setsuko Ino | Setsuko Ino has many years of experience in charge of management planning in the IT industry and at global companies, and has a global perspective as well as extensive knowledge of finance, accounting, and IT. In view of her extensive experience, she is nominated as a candidate for Outside Audit & Supervisory Board Member in expectation of further contribution to the auditing processes of the Company. |

Evaluation of the Board of Directorsʼ Effectiveness

In order to confirm and verify the validity of the Company's effectiveness evaluation process, the Company retains a third party to conduct an effectiveness evaluation once every three years in principle.

The Company discloses the overview of the methods, processes, and results of the effectiveness evaluation for each fiscal year in the Kubota Group Integrated Report and the Kubota Group ESG Report.

Remuneration

Currently, the Company is committed to shift to business operations with ESG positioned at the core of management under the Long‐Term Vision“GMB2030,” with the aim of further strengthening the supervisory function of the Board of Directors (i.e. enhancing corporate governance). Under these circumstances, Kubota Corporation reviewed the remuneration plan for the Directors as responsibilities and expectations of the Directors are increasing. Following is the policy for determination of remuneration, etc. and its calculation method for the Directors and Executive Officers.

- Basic policy for determination of remuneration, etc. for the Directors

-

- a) The purpose of the remuneration is to encourage the Directors, excluding Outside Directors, to take the lead for sustainable growth while fulfilling social responsibilities as a company aiming to become a GMB.

-

- Motivate the Directors to achieve performance targets by reflecting in their remuneration quantitative and objective evaluation results based on financial performance indicators.

- Accelerate K‐ESG management initiatives by reflecting evaluation results of the progress of the K‐ESG in remuneration of the Directors.

- Encourage the Directors to hold shares of Kubota Corporation during their tenure and make them strongly aware of the need to sustainably improve corporate value through a remuneration system that is closely linked to shareholder value.

- Set the levels of remuneration and performance linkage so that the Directors may receive remuneration that is equivalent to or greater than the standard remuneration at other GMB companies defined by Kubota Corporation, in line with the achievement of the performance targets and K‐ESG, and improvement of corporate value.

- b) To achieve the purpose of the remuneration, transparency and objectivity must be ensured in the administration of the remuneration plan.

-

- Decisions on the development and administration of remuneration policies shall be reviewed by the Compensation Advisory Committee, where a majority of members are Outside Directors, before being determined by the Board of Directors’ resolution.

- In order to fulfill accountability for shareholders precisely, disclosure shall be made not limited to the scope required by laws and regulations, but also to facilitate shareholders’ understanding and dialogue with them.

Remuneration plan overview

- 1.Remuneration structure

-

The remuneration for the Directors, excluding Outside Directors, consists of basic remuneration, which is fixed, and performance-linked remuneration. The composition ratio of basic remuneration to performance-linked remuneration for the President and Representative Director is generally set as 1:3, to secure a high level of performance linkage suitable for a competitive remuneration level. As for the remuneration structure for the Directors other than the President and Representative Director, the Directors at a higher corporate rank earn a greater portion of performance-linked remuneration, given the size of their duties, etc. of each corporate rank.

For Outside Directors, remuneration consists of basic remuneration, which is fixed, and - to encourage further value sharing with shereholders - restricted stock units that are not linked to business performance. The composition ratio of basic remuneration to stock compensation is set at approximately 1:0.2. - 2.Remuneration level

- In order to properly secure competitiveness in terms of compensation suitable for a GMB company, Kubota appropriately sets the level of remuneration for the Directors, excluding Outside Directors, based on their corporate ranks and duties, by using data on objective executive remuneration surveys conducted by an external specialized institution, etc. to identify a group of companies whose size, profitability, type of business, overseas networks, etc. are comparable to those of Kubota as a benchmark for comparison

-

For further information on the remuneration, please refer to the Kubota Group Integrated Report/ESG Report.